Withholding allowances used to be a way employees could adjust how much money employers take out of their paychecks for federal income tax. Although the IRS removed withholding allowances for federal income tax in 2020, they’re still out there—through pre-2020 W-4 forms and state income tax.

Read More Federal Withholding Allowances Still Axed, but Some State Allowances Live OnPayroll Taxes Articles

Payroll Taxes - Tips, Training, and News

Most popular blog categories

New AZ State Income Tax Form Requires Employer Action

Arizona employers, you may know that Senate Bill 1828 substantially reduced the state’s income taxes starting with the 2022 tax year. But did you also know that it requires employer action for the 2023 tax year? You must now give all employees—not just new hires—a new AZ state income tax form.

Read More New AZ State Income Tax Form Requires Employer Action

How to Do Payroll: Your Step-by-step Guide on Paying Employees

If you’re becoming an employer or already have employees, you must learn how to do payroll. Handling payroll is an important employer responsibility with many steps. Familiarize yourself on how to do payroll by learning about what payroll information you need to gather and the steps you need to follow to pay employees.

Read More How to Do Payroll: Your Step-by-step Guide on Paying Employees

Correcting Employment Taxes: What to Do If You Withhold the Wrong Amount

It’s easy to make mistakes, especially when you have a million and one things on your plate. One error you could make is deducting the wrong amount from employee wages. Correcting employment taxes is necessary if you withhold too much or too little from your employees’ paychecks.

Read More Correcting Employment Taxes: What to Do If You Withhold the Wrong Amount

What’s Your Payroll Tax Deposit Schedule? If You’re Not Sure, Read This

When you have employees, your responsibility isn’t just to pay them. You also need to pay the IRS their share, too. How often you pay the IRS depends on your payroll tax deposit schedule. But, not all employers follow the same schedule. Your schedule, and thus payroll tax deposit due dates, depends on the type […]

Read More What’s Your Payroll Tax Deposit Schedule? If You’re Not Sure, Read This

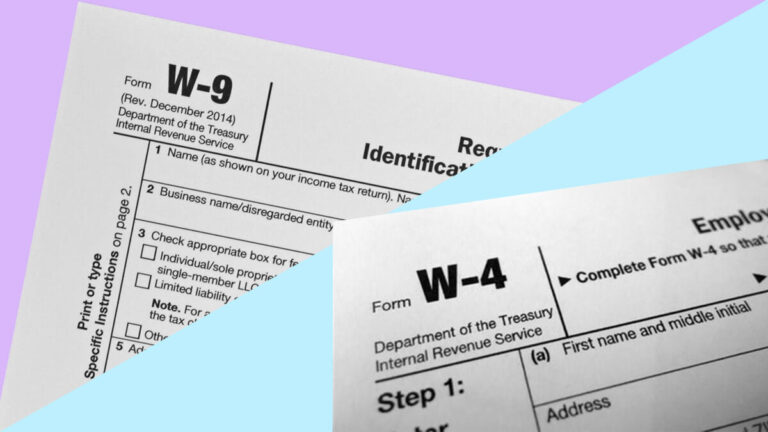

Form W-9 vs. W-4: What Are the Right Forms for Employees and Contractors?

You must withhold the right amount of taxes on employee wages when paying employees. But what if you need to pay an independent contractor? To keep tax information straight between independent contractors and employees, you need to know the difference between Form W-9 vs. W-4. Read on for the scoop.

Read More Form W-9 vs. W-4: What Are the Right Forms for Employees and Contractors?

State Tax ID: What Is It, How to Apply, & Beyond

If you have employees, you have responsibilities—one of which is to obtain a Federal Employer Identification Number (FEIN). But, that’s not the only identifying number you need. More than likely, you also need a state tax ID number.

Read More State Tax ID: What Is It, How to Apply, & Beyond

Optimizing Employee Discounts: A Comprehensive Guide for Small Businesses

Want to encourage employees to sport your company’s apparel? Or, looking for an employee benefit that’s appealing to new hires? You may consider offering employee discounts. Employee discount programs for small business come with several business benefits, like increased retention and sales. But before offering them, understand what qualifies as an employee discount and whether […]

Read More Optimizing Employee Discounts: A Comprehensive Guide for Small Businesses

What Is State Income Tax?

Tax withholding may not be the most glamorous part of being a business owner. But if you have employees, it’s part of the job. In addition to federal income tax withholding, you may also need to handle state income tax withholding. Unlike federal income tax, state income tax rules and rates vary by state. So, […]

Read More What Is State Income Tax?

“Do I Need to Pay That?” All About FUTA Tax Exemption

As an employer, you’re responsible for many different payroll taxes, including FUTA tax (aka, federal unemployment tax). But in some cases, you may not be responsible for paying FUTA tax. In fact, some businesses are exempt from the tax altogether. Get to know all about FUTA tax exemption and whether or not your business has […]

Read More “Do I Need to Pay That?” All About FUTA Tax Exemption